From Disco to Wall Street:

A Career Building Companies

A.J. CERVANTES, JR.

There are many labels that could apply to the remarkable career of A.J. Cervantes, Jr.: Successful capital markets executive. Venture capital professional. Merchant banker. Entrepreneur. Marketer. Radio journalist. Music and film producer. But ultimately the most accurate term is company builder. Says A.J.: “I’m agnostic and opportunistic – in all the best ways. What matters is the instinct to see opportunities and the ability to build companies to capitalize on them.” A.J. has done this throughout his entire career, in numerous sectors with numerous companies.

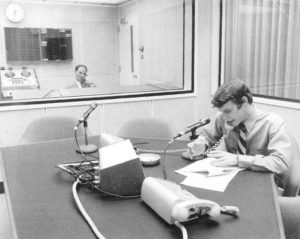

A.J.’s initial love was Media, specifically radio. Fresh out of high school, at 18, A.J. became News Director and a DJ for KLPW-AM/FM in Union, MO, a small outstate station an hour from his hometown of St. Louis. Then at 19, he entered Webster University in St. Louis where he pursued a degree in Media.

A.J.’s initial love was Media, specifically radio. Fresh out of high school, at 18, A.J. became News Director and a DJ for KLPW-AM/FM in Union, MO, a small outstate station an hour from his hometown of St. Louis. Then at 19, he entered Webster University in St. Louis where he pursued a degree in Media.  Not content merely to attend classes, A.J. landed a job as Night News Editor at KMOX-CBS Radio, holding down the midnight to 7 am shift, five days a week, and Sundays from noon to midnight. He not only generated hourly news, he wrote “vignettes” and documentaries. A.J. was the youngest news editor in the national CBS Radio Owned & Operated network.

Not content merely to attend classes, A.J. landed a job as Night News Editor at KMOX-CBS Radio, holding down the midnight to 7 am shift, five days a week, and Sundays from noon to midnight. He not only generated hourly news, he wrote “vignettes” and documentaries. A.J. was the youngest news editor in the national CBS Radio Owned & Operated network.

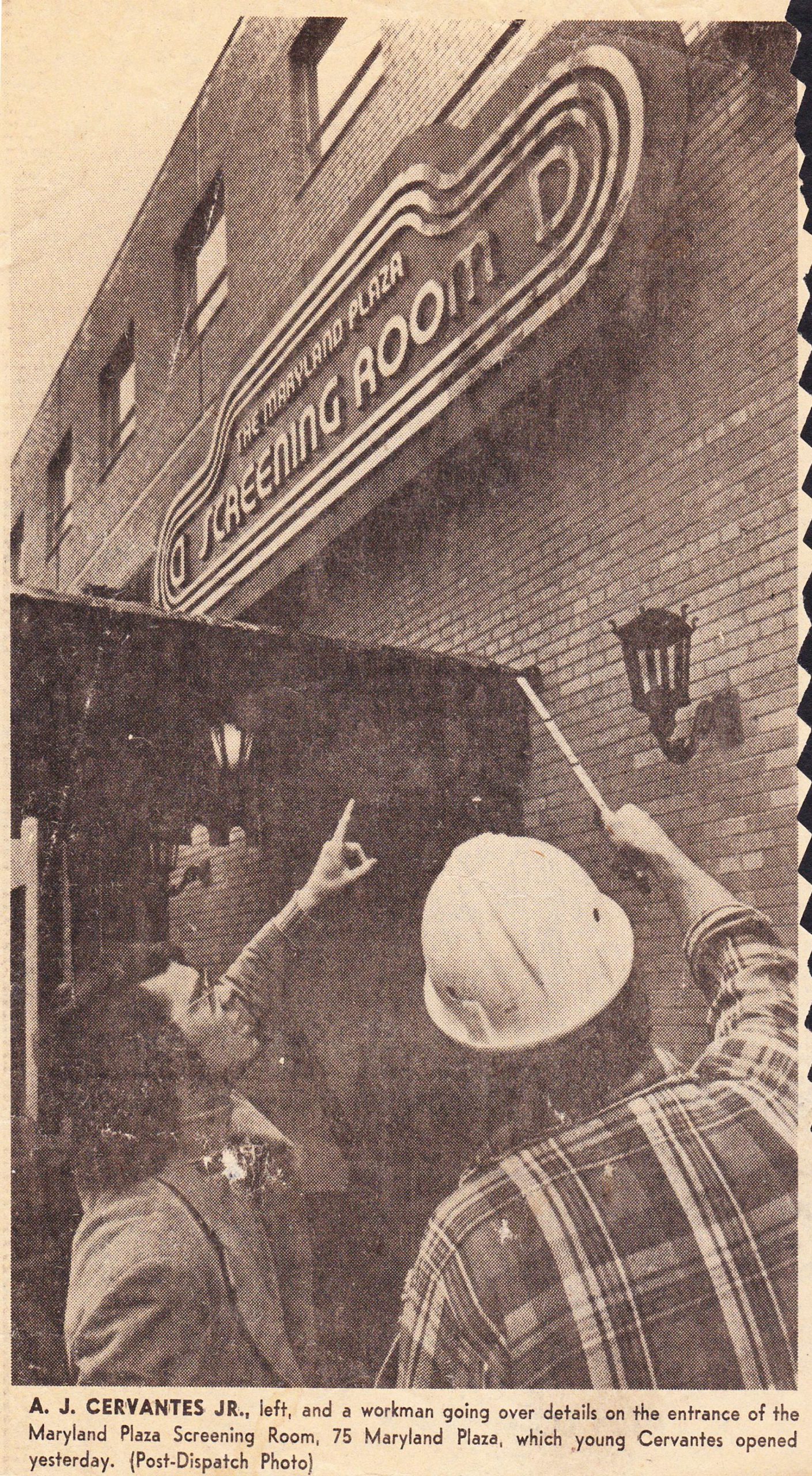

After college, at 23, A.J. opened an upscale restaurant/theatre, a “cine bistro” called the Maryland Plaza Screening Room, in St. Louis. It was an elegant theatre serving gourmet treats with wine and liquor, showing classic movies. It was a fit for the pre-DVD, pre-cable world where audiences had limited access to historic films.

Going Hollywood.

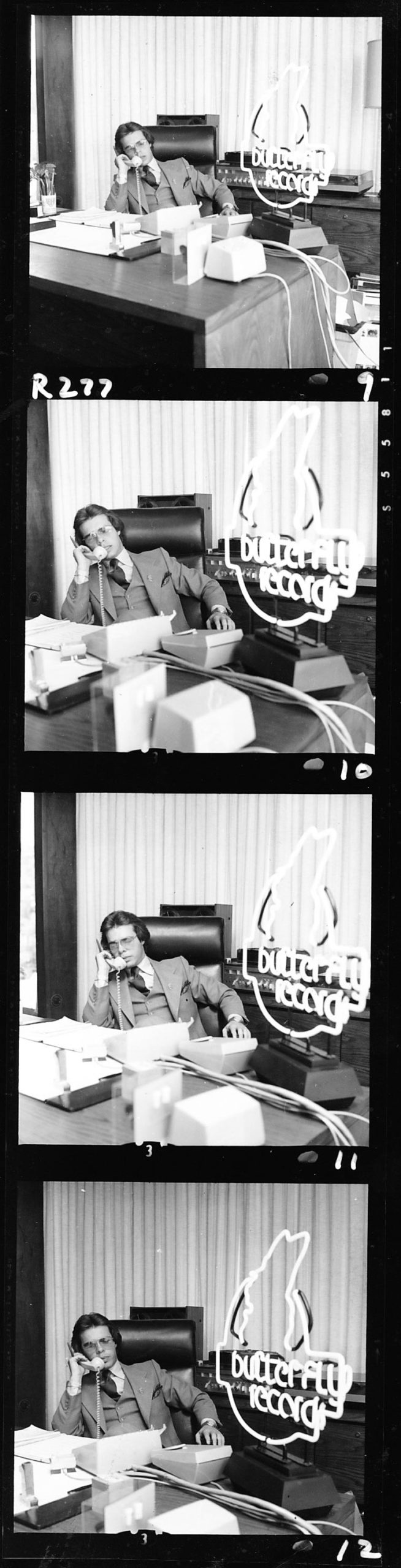

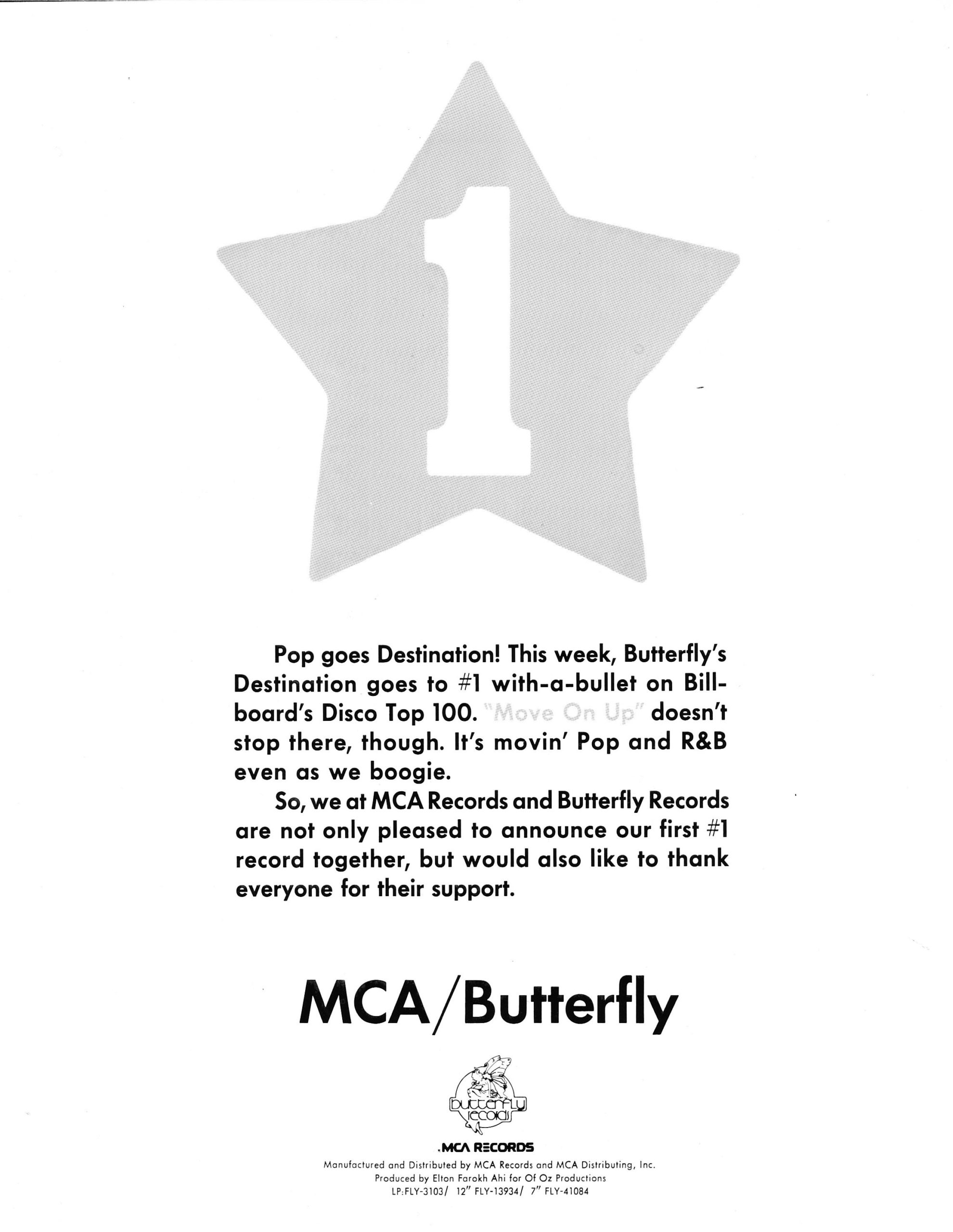

At 26, A.J. moved to Los Angeles in search of bigger opportunities. It was the 1970s and the Disco revolution was growing into a major cultural force, with millions crowding into the clubs every week and the music permeating the airwaves. Initially working with artists such as Donna Summer as part of Casablanca Records’ national marketing team, A.J. decided to launch his own label and started Butterfly Records in 1976. He and his team contracted artists, producers, writers for recording and releasing a broad slate of Disco music domestically and internationally. Within two years, at the zenith of the Disco revolution, A.J. had built Butterfly into a major independent dance/Disco label. In its first year alone, Butterfly generated numerous chart successes, including a Billboard number Disco record for four weeks running, Destination’s “Move on Up.” Other acts included St. Tropez, THP Orchestra and Tuxedo Junction.

In 1979, A.J. negotiated a $6 million, four-year contract with MCA Universal Music for domestic distribution of Butterfly’s catalogue while retaining foreign rights. In the summer of 1979, Butterfly represented 25% of MCA’s entire release schedule. When the Disco market crashed in the latter part of 1979, MCA reneged on the contract and Butterfly spent five years in litigation with the entertainment giant in a case that became California case law but was ultimately unsuccessful. (He was once quoted in a book about Jules Stein, the Chairman of MCA, observing that MCA is “not an entertainment company but a law firm pretending to be an entertainment company.”) In yet another classic pivot, A.J. repositioned the Butterfly catalogue for extensive licensing for everything from films and commercials to aerobic tapes throughout selling it to Warner Music in 1988.

In 1979, A.J. negotiated a $6 million, four-year contract with MCA Universal Music for domestic distribution of Butterfly’s catalogue while retaining foreign rights. In the summer of 1979, Butterfly represented 25% of MCA’s entire release schedule. When the Disco market crashed in the latter part of 1979, MCA reneged on the contract and Butterfly spent five years in litigation with the entertainment giant in a case that became California case law but was ultimately unsuccessful. (He was once quoted in a book about Jules Stein, the Chairman of MCA, observing that MCA is “not an entertainment company but a law firm pretending to be an entertainment company.”) In yet another classic pivot, A.J. repositioned the Butterfly catalogue for extensive licensing for everything from films and commercials to aerobic tapes throughout selling it to Warner Music in 1988.

During this period, A.J. was also building a new entertainment industry company. In 1983, he and business partner Ron Altbach (of King Harvest and Beach Boys fame) formed Mediacom Industries and took it public with his position as CEO marking the beginning of A.J.’s career in capital markets. Mediacom and its production subsidiary, Mediacom Filmworks, a film and television production company, produced feature films, music videos and television specials (including Showtime’s highly rated “DC Beach Party” at the Washington Monument on Fourth of July with the Beach Boys, Ringo Star, America, Julio Iglesias, Hank Williams Jr., and the O’Jays—with a half a million in attendance).

During this period, A.J. was also building a new entertainment industry company. In 1983, he and business partner Ron Altbach (of King Harvest and Beach Boys fame) formed Mediacom Industries and took it public with his position as CEO marking the beginning of A.J.’s career in capital markets. Mediacom and its production subsidiary, Mediacom Filmworks, a film and television production company, produced feature films, music videos and television specials (including Showtime’s highly rated “DC Beach Party” at the Washington Monument on Fourth of July with the Beach Boys, Ringo Star, America, Julio Iglesias, Hank Williams Jr., and the O’Jays—with a half a million in attendance).

To capitalize on the nascent VCR revolution and the need for lower cost feature films to populate the shelves of the proliferation of Blockbuster-type stores, the company produced “Shadows in the Storm” starring Ned Beatty, Mia Serra and Michael Madsen and “Blueberry Hill” starring Matt Lattanzi and Jennifer Ruben and released by MGM. Other productions included “Nights in White Satin” and “House of the Rising Sun.” After the stock market crash of October 1987, the ability to raise capital for independent films became impossible in that risk-adverse environment, so A.J. restructured the company, took it private, and in 1990 sold it.

To capitalize on the nascent VCR revolution and the need for lower cost feature films to populate the shelves of the proliferation of Blockbuster-type stores, the company produced “Shadows in the Storm” starring Ned Beatty, Mia Serra and Michael Madsen and “Blueberry Hill” starring Matt Lattanzi and Jennifer Ruben and released by MGM. Other productions included “Nights in White Satin” and “House of the Rising Sun.” After the stock market crash of October 1987, the ability to raise capital for independent films became impossible in that risk-adverse environment, so A.J. restructured the company, took it private, and in 1990 sold it.

Given his success restructuring Mediacom in the post-crash stock market environment, A.J. saw an opportunity to move into the turnaround business. In 1991, he began restructuring troubled companies to give them new life in the marketplace, as well as better returns for their owners and investors. His restructurings were both in-court Chapter 11 proceedings and out-of-court. They included Pearce Systems International, a proprietary building products company based in Los Angeles which owned the “Pearce Multi-hinge Connection System,” a patented connection system that was able to create column free, long span structures, including the Biosphere II in Arizona, the Universal City dome in Los Angeles and the Navy Pier in Chicago. Though its products were both unique and valuable, the company was highly distressed. A.J. restructured it and took it public in February of 1994.

Given his success restructuring Mediacom in the post-crash stock market environment, A.J. saw an opportunity to move into the turnaround business. In 1991, he began restructuring troubled companies to give them new life in the marketplace, as well as better returns for their owners and investors. His restructurings were both in-court Chapter 11 proceedings and out-of-court. They included Pearce Systems International, a proprietary building products company based in Los Angeles which owned the “Pearce Multi-hinge Connection System,” a patented connection system that was able to create column free, long span structures, including the Biosphere II in Arizona, the Universal City dome in Los Angeles and the Navy Pier in Chicago. Though its products were both unique and valuable, the company was highly distressed. A.J. restructured it and took it public in February of 1994.

In 1992, A.J. bought International Paging Company, based in Pasadena, CA. Though deeply distressed, the operation was one of the top five national paging companies. Motorola was the company’s largest creditor, at more than $10 million. When negotiations to restructure the Motorola debt failed, litigation ensued, so A.J. strategically filed Chapter 11 for the company. Ultimately, the bankruptcy courts appointed a receiver and reopened the sale process to other companies, and while A.J. lost the bid he suffered no financial losses.

Partnering with golf legend Gary Player.

In 1996, with the high-end sports sector surging, A.J. and a group of investors created Golf One, Inc., with A.J. as the CEO. Golf One purchased Rhino Golf, an online golf equipment marketing company based in Santa Maria, CA. The next year, A.J. negotiated a licensing agreement with legendary golfer Gary Player and rebranded the line Gary Player Black Knight. In 1998, Gary Player Golf filed for an IPO with A.J. as President and Gary Player as Chairman, with Whale Securities, New York, as the underwriter. At that time, the Asian Crisis continued and, ultimately, the offering had to be postponed. It was the same time frame Goldman Sachs, in the process of taking itself public, had to postpone its own IPO due to the crisis. Subsequently, A.J. merged Gary Player Golf into Carriere Golf, a small public golf equipment company, and effected a name change to Gary Player Direct. A.J. left Gary Player at the end of 1999 when new management assumed control of the company. He positioned himself as consultant to early stage public companies, migrating his business to Palm Desert, CA in what he called a “sabbatical.”

In 1996, with the high-end sports sector surging, A.J. and a group of investors created Golf One, Inc., with A.J. as the CEO. Golf One purchased Rhino Golf, an online golf equipment marketing company based in Santa Maria, CA. The next year, A.J. negotiated a licensing agreement with legendary golfer Gary Player and rebranded the line Gary Player Black Knight. In 1998, Gary Player Golf filed for an IPO with A.J. as President and Gary Player as Chairman, with Whale Securities, New York, as the underwriter. At that time, the Asian Crisis continued and, ultimately, the offering had to be postponed. It was the same time frame Goldman Sachs, in the process of taking itself public, had to postpone its own IPO due to the crisis. Subsequently, A.J. merged Gary Player Golf into Carriere Golf, a small public golf equipment company, and effected a name change to Gary Player Direct. A.J. left Gary Player at the end of 1999 when new management assumed control of the company. He positioned himself as consultant to early stage public companies, migrating his business to Palm Desert, CA in what he called a “sabbatical.”

That sabbatical was interrupted in 2001 when Ron Altbach, A.J.’s former Mediacom partner, called. Ron, who was then based in New York, building a major public company called Cross Media Marketing, asked A.J. to “retire” from his Palm Springs “sabbatical” and move to New York to help build the company. First resisting, A.J. finally agreed, and moved to New York. Among his responsibilities was command of the company’s corporate communications— including branding, positioning and messaging of the company to Wall Street and the capital markets. He quickly mastered next-gen communications technologies, including extensive database marketing, corporate videos, and email affinity marketing. A.J.’s primary area of responsibility was capital markets management and strategic communications. He was the principal architect of the company’s market value—over $250 million at its peak.

Innovation in capital markets communications.

Buoyed by the success of his Cross Media corporate communications programs, A.J. left the company with a new idea gestating. In 2003, he started Trilogy Capital Partners to specialize in providing high-level strategic communications and M&A advisory that he had pioneered at Cross Media. Based in New York, from 2003 until 2010, Trilogy represented over 150 emerging growth public companies and was the architect of numerous market successes. He became a frequent public speaker at capital markets events, discussing the innovative, technology-driven visibility and communications strategies he had developed for his clients. In 2015, Trilogy Capital Partners was merged with Trilogy Capital Group, A.J.’s boutique private equity group which is his primary investment vehicle today.

Buoyed by the success of his Cross Media corporate communications programs, A.J. left the company with a new idea gestating. In 2003, he started Trilogy Capital Partners to specialize in providing high-level strategic communications and M&A advisory that he had pioneered at Cross Media. Based in New York, from 2003 until 2010, Trilogy represented over 150 emerging growth public companies and was the architect of numerous market successes. He became a frequent public speaker at capital markets events, discussing the innovative, technology-driven visibility and communications strategies he had developed for his clients. In 2015, Trilogy Capital Partners was merged with Trilogy Capital Group, A.J.’s boutique private equity group which is his primary investment vehicle today.

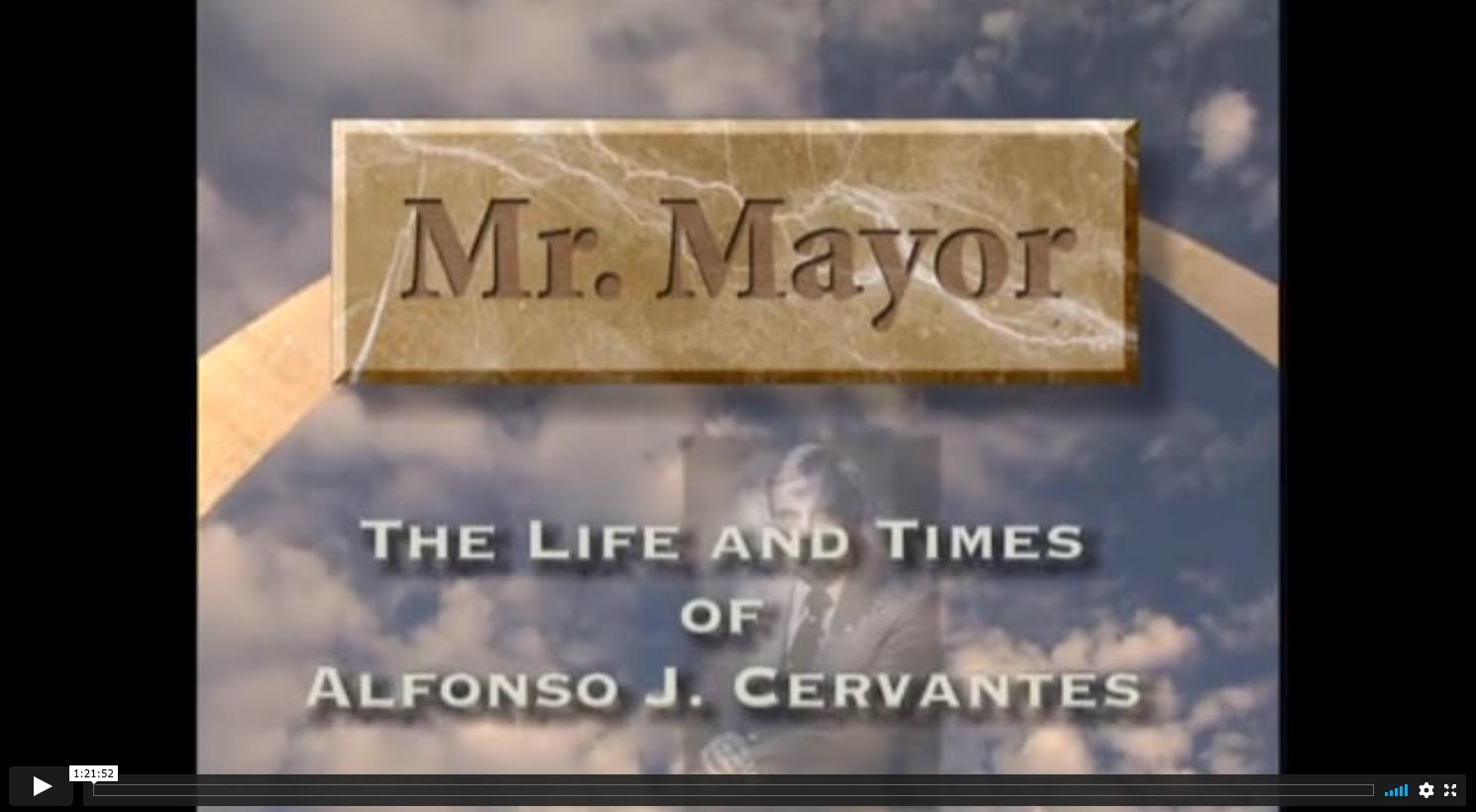

Also, in 2005, as a labor of love, A.J. produced a feature length documentary telling the story of his remarkable father, A.J. Cervantes, Sr. The documentary, entitled “Mr. Mayor, the Life and Times of Alfonso J. Cervantes,” was the premier film for the St. Louis Film Festival, one of 132 productions over 10 days in St. Louis in 2006.

In 2008, A.J. formed Regeneration Capital Group, Inc., to continue his capital markets work. At the moment in time that the China sector was becoming vibrant, A.J. capitalized on Wall Street’s interest in privately held Chinese companies seeking US listing. After spending significant time in mainland China, he identified Bohai Pharmaceuticals, Inc. as an ideal candidate. Engaged in Traditional Chinese Medicine, which was becoming increasingly popular in the U.S. and worldwide, Bohai was a highly profitable company based in Yantai, China. Regeneration, with Ron Altbach as a partner, assembled a state-of-the art capital markets team to bring Bohai public in the US, organizing securities counsel, PCAOB auditors, Investor Relations and a marketing team. While the China sector subsequently imploded several years later, the investors and Regeneration enjoyed great success as founding shareholders capitalizing on the company’s early market acceptance. A.J. sold his interest in Regeneration in 2010.

Success with IPOs.

In 2012, through Trilogy, A.J. acquired controlling interest of the public company Golden Fork, Inc., a dormant restaurant company. With partner Darren Minton, A.J. repositioned the company in the temporary staffing industry—a sector he felt was ideally suited for a consolidation or rollup due to the fragmentation in the market, where countless “mom and pop” staffing agencies operated, typically generating less than $25 million a year in revenues. He named the new company Staffing 360 Solutions, Inc. As a pure startup in 2012, Staffing 360 had no employees and no revenues but by 2004 was generating $140 million in revenue with 3,000 employees worldwide. In the first two years, A.J. acquired five companies. It is now Nasdaq-listed (STAF) with approximately $300 million in revenues.

After installing new management and a board of directors, A.J. left Staffing 360 at the end of 2004 and moved Trilogy Capital to Miami.

After installing new management and a board of directors, A.J. left Staffing 360 at the end of 2004 and moved Trilogy Capital to Miami.

In Miami, Trilogy opened new offices in late 2015 and as a boutique Private Equity group explored various industries that A.J. felt lent themselves to rollup strategies, with an IPO as the ultimate objective. In conjunction with his analysts, A.J. explored concepts in entertainment, senior living, and fast food—(that last area led to his purchase of The Original Grilled Cheese Truck, an award-winning food truck serving gourmet grilled cheese sandwiches and based in Los Angeles.) Finally, he settled on the nutraceutical industry, including vitamins, supplements, and health-promoting foods. A.J. reasoned that the nutraceutical industry, much like the temporary staffing industry, lent itself to consolidation due to the fragmentation of the market and the existence of so many small companies.

As a result, in 2017, A.J. formed Bonne Santé Group, Inc. with partner Darren Minton and in 2018 made the first acquisition: Millennium Natural Health Manufacturing, Inc., a 22,000-square-foot, state-of-the-art FDA-certified nutraceutical manufacturing facility in Doral, FL. Trilogy Capital, A.J.’s holding company, is the majority shareholder of Bonne Santé.

As of this writing, Bonne Santé has a number of prospective acquisitions in the pipeline and plans to be public by year-end 2020. To that end, Bonne Santé entered into a $30 million engagement agreement with a major middle market New York investment banking group for an Initial Public Offering.

As they say in broadcasting, “Stay tuned!”

Summary.

The entrepreneurial road is a challenging one. With its twists and turns and ups and down, it is fraught with peril at every turn, from bad guy relationships to highly adverse market conditions and pandemics. It is clear that it takes fortitude and faith to make these companies work – and not all have – but A.J.’s tenacity, creative thinking, keen understanding of the capital markets, securities laws, corporate governance, capital formation and execution have all contributed to the success known as A.J. Cervantes, Jr.